INTEGRATIONS | BARN2DOOR + AVALARA

Tax Compliance

Why Barn2Door + Avalara?

Avalara is the best-in-class third-party tax solution for businesses of all sizes. The Barn2Door integration with Avalara provides Farmers with fast, seamless, and highly accurate tax compliance automation to reduce audit risk and ensure accurate tax transactions. Avalara is particularly useful for Farmers who utilize shipping or delivery across state lines or operate in states with complex tax requirements.

With Avalara, Farmers are equipped with all the tools they need to ensure their businesses are tax compliant.

Easily set up and manage tax codes for each product.

Avalara will automatically apply real-time taxes no matter where you or your customers are located.

Have peace of mind knowing your taxes are up to date (even in the most complex tax districts).

Features

Geolocation Rate Charges

Sales and use tax rates are complex and vary across jurisdictions, counties, and state lines. Avalara assesses real-time rates based on geolocation (not zip codes) where Buyers are charged the correct rate for their purchases from your Farm.

Apply Appropriate Tax Rates

Avalara calculates the proper tax rate for various circumstances, including product-specific tax rates, sales tax holidays, shipping and handling rules, and more.

On-Demand Reporting

Farmers can easily generate reports on transactions, liabilities, and tax exemptions. Avalara reports will allow Farmers to save money and the amount of time it takes to prepare tax returns or address auditor requests.

Pricing

NO Markups on Products. NO % of Gross Sales. NO Fees to Buyers.

All prices below are based on annual payments:

Business

$129 / month

(with a one time $499 setup fee)

Branded Farm Webstore

Custom Website (Hosting Included)

Subscriptions

Seamless Tax Integration

M-F Live Farmer Chat Support

Scale

$199 / month

(with a one time $599 setup fee)

Branded Farm Webstore

Custom Website (Hosting Included)

Subscriptions

Seamless Tax Integration

M-F Live Farmer Chat Support

M-F Live Buyer Chat Support

FAQs about Barn2Door + Avalara

-

Both. Avalara will automatically calculate the appropriate tax rate based on the specific tax requirements for the state in which the Farmer is located (origin-based sales tax states) or for the state to which the item is being shipped (destination-based sales tax states).

-

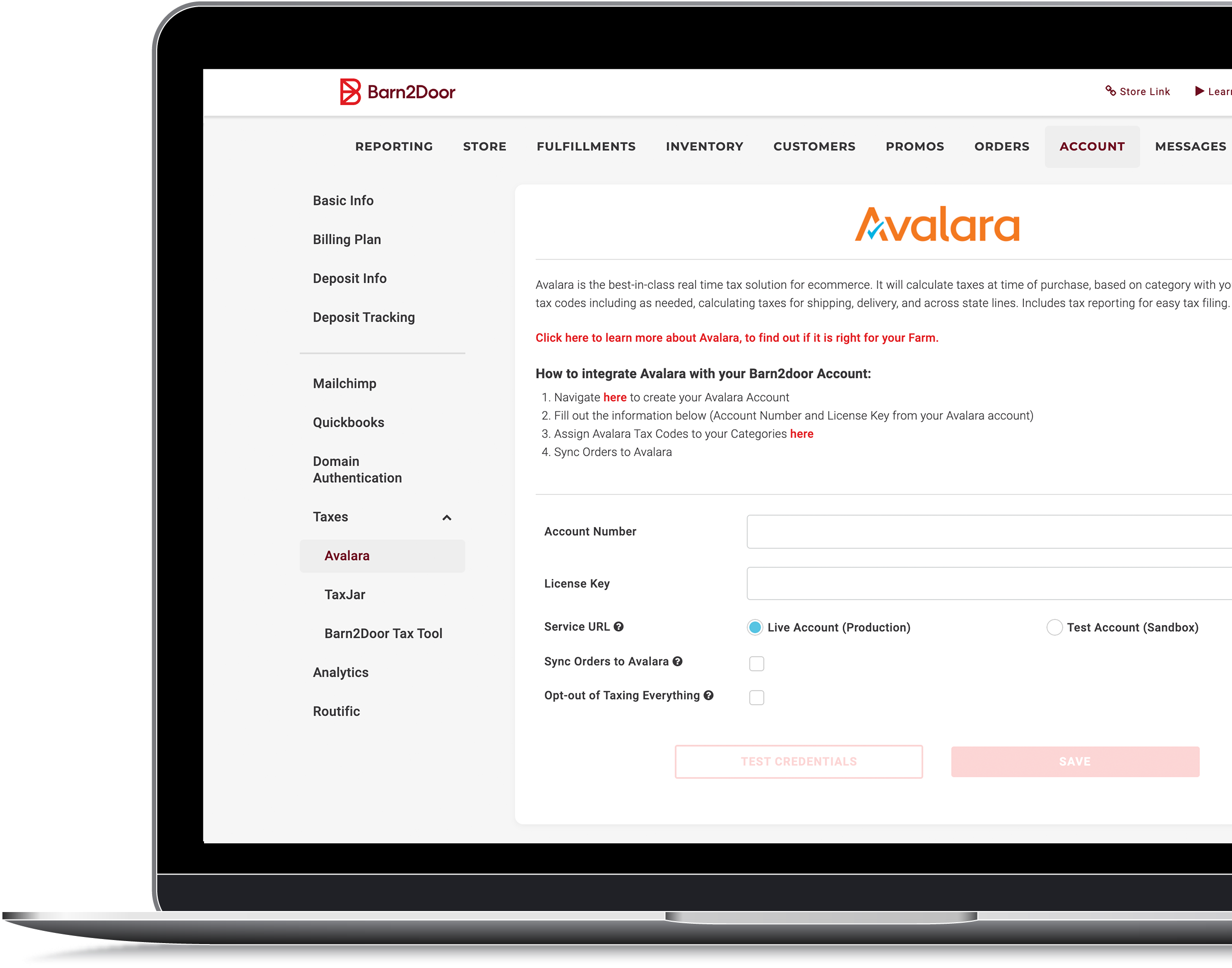

To connect Barn2Door with Avalara, you must set up an account with Avalara first. You may join the accounts from the Account page on Barn2Door. Avalara is located under the ‘Taxes’ tab in the left-hand navigation menu.

Note: you must have an account number and a license key to sync the two accounts properly.

-

Farmers can assign tax codes to items from the dropdown menu in the Basics section of the Offer Details page. This is where Farmers can also adjust an item’s tax code when editing an existing product.

-

Barn2Door is unable to give tax recommendations as we are not attorneys or licensed accountants. If you have any specific questions about tax compliance or applying tax codes, we recommend discussing them with your accountant or attorney.

We’re proud to help Farmers grow and manage direct sales.

If you’re curious how Barn2Door can help your Farm build a thriving direct-to-market business, watch this 5 minute video.